How Do I Get A Sales Tax Exemption In South Carolina . Once you've successfully registered to collect south carolina sales tax, you'll need to apply the correct rate to all taxable sales, remit sales tax,. Sales and use tax are exempt from local sales and use tax administered and collected by the department on behalf of local jurisdictions,. Learn more about south carolina sales tax exemptions. While the south carolina sales tax of 6% applies to most transactions, there. Applying for a sales & use tax exemption. The state of south carolina levies a 6% state sales tax, local sales tax is up to 2.5%. You will need to provide. Sales & use taxpayers whose south carolina tax liability is $15,000 or more per filing period must file and pay electronically. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. The scdor offers sales & use tax exemptions to qualified taxpayers. What purchases are exempt from the south carolina sales tax?

from www.exemptform.com

Sales & use taxpayers whose south carolina tax liability is $15,000 or more per filing period must file and pay electronically. While the south carolina sales tax of 6% applies to most transactions, there. What purchases are exempt from the south carolina sales tax? The scdor offers sales & use tax exemptions to qualified taxpayers. Once you've successfully registered to collect south carolina sales tax, you'll need to apply the correct rate to all taxable sales, remit sales tax,. Sales and use tax are exempt from local sales and use tax administered and collected by the department on behalf of local jurisdictions,. Applying for a sales & use tax exemption. Learn more about south carolina sales tax exemptions. You will need to provide. The state of south carolina levies a 6% state sales tax, local sales tax is up to 2.5%.

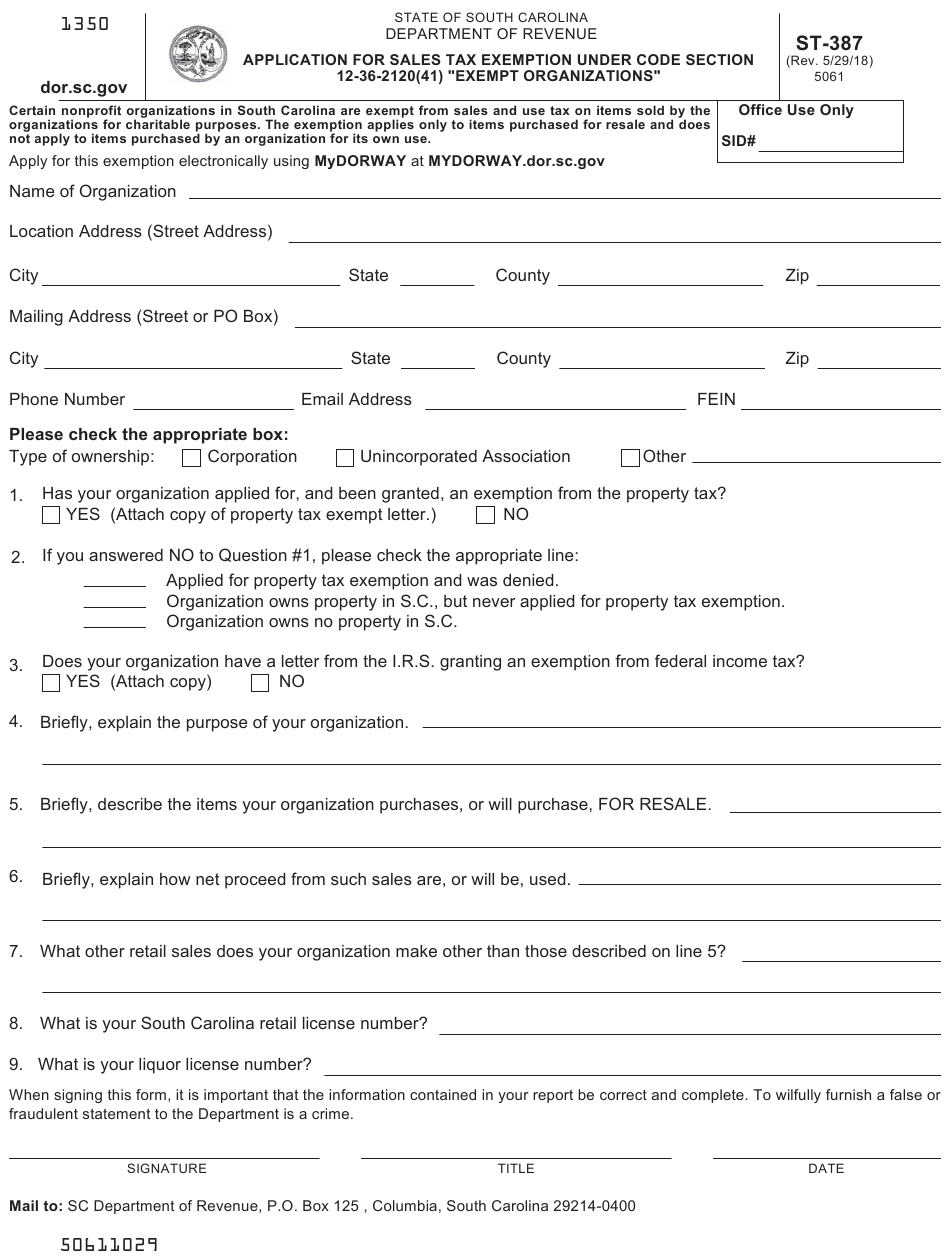

South Carolina State Sales Tax Exemption Form

How Do I Get A Sales Tax Exemption In South Carolina What purchases are exempt from the south carolina sales tax? Applying for a sales & use tax exemption. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. Sales & use taxpayers whose south carolina tax liability is $15,000 or more per filing period must file and pay electronically. Once you've successfully registered to collect south carolina sales tax, you'll need to apply the correct rate to all taxable sales, remit sales tax,. The state of south carolina levies a 6% state sales tax, local sales tax is up to 2.5%. Learn more about south carolina sales tax exemptions. What purchases are exempt from the south carolina sales tax? You will need to provide. While the south carolina sales tax of 6% applies to most transactions, there. Sales and use tax are exempt from local sales and use tax administered and collected by the department on behalf of local jurisdictions,. The scdor offers sales & use tax exemptions to qualified taxpayers.

From tutore.org

Toll Tax Exemption Certificate Format Master of Documents How Do I Get A Sales Tax Exemption In South Carolina Sales and use tax are exempt from local sales and use tax administered and collected by the department on behalf of local jurisdictions,. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. Once you've successfully registered to collect south carolina sales tax, you'll need to. How Do I Get A Sales Tax Exemption In South Carolina.

From www.prosecution2012.com

South Carolina Sales Tax Exemption Certificate Verification How Do I Get A Sales Tax Exemption In South Carolina Learn more about south carolina sales tax exemptions. Once you've successfully registered to collect south carolina sales tax, you'll need to apply the correct rate to all taxable sales, remit sales tax,. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. You will need to. How Do I Get A Sales Tax Exemption In South Carolina.

From www.exemptform.com

How To Get A Sales Tax Certificate Of Exemption In North Carolina How Do I Get A Sales Tax Exemption In South Carolina You will need to provide. Sales and use tax are exempt from local sales and use tax administered and collected by the department on behalf of local jurisdictions,. What purchases are exempt from the south carolina sales tax? The scdor offers sales & use tax exemptions to qualified taxpayers. While the south carolina sales tax of 6% applies to most. How Do I Get A Sales Tax Exemption In South Carolina.

From www.exemptform.com

FREE 10 Sample Tax Exemption Forms In PDF How Do I Get A Sales Tax Exemption In South Carolina A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. What purchases are exempt from the south carolina sales tax? Once you've successfully registered to collect south carolina sales tax, you'll need to apply the correct rate to all taxable sales, remit sales tax,. Applying for. How Do I Get A Sales Tax Exemption In South Carolina.

From www.exemptform.com

South Carolina State Sales Tax Exemption Form How Do I Get A Sales Tax Exemption In South Carolina You will need to provide. While the south carolina sales tax of 6% applies to most transactions, there. The scdor offers sales & use tax exemptions to qualified taxpayers. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. What purchases are exempt from the south. How Do I Get A Sales Tax Exemption In South Carolina.

From sherigratiana.pages.dev

State Of Ohio Sales Tax Exempt Form 2024 Cally Corette How Do I Get A Sales Tax Exemption In South Carolina The state of south carolina levies a 6% state sales tax, local sales tax is up to 2.5%. Sales and use tax are exempt from local sales and use tax administered and collected by the department on behalf of local jurisdictions,. Applying for a sales & use tax exemption. You will need to provide. While the south carolina sales tax. How Do I Get A Sales Tax Exemption In South Carolina.

From www.uslegalforms.com

NC Certification of 501(c)(3) or Other TaxExempt Status 2011 Fill How Do I Get A Sales Tax Exemption In South Carolina Applying for a sales & use tax exemption. What purchases are exempt from the south carolina sales tax? You will need to provide. Sales and use tax are exempt from local sales and use tax administered and collected by the department on behalf of local jurisdictions,. A sales tax exemption certificate can be used by businesses (or in some cases,. How Do I Get A Sales Tax Exemption In South Carolina.

From www.pdffiller.com

Tax Exempt Form Fill Online, Printable, Fillable, Blank pdfFiller How Do I Get A Sales Tax Exemption In South Carolina Applying for a sales & use tax exemption. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. Once you've successfully registered to collect south carolina sales tax, you'll need to apply the correct rate to all taxable sales, remit sales tax,. The scdor offers sales. How Do I Get A Sales Tax Exemption In South Carolina.

From www.signnow.com

Sc Sales Tax Exemption 20162024 Form Fill Out and Sign Printable PDF How Do I Get A Sales Tax Exemption In South Carolina Learn more about south carolina sales tax exemptions. The state of south carolina levies a 6% state sales tax, local sales tax is up to 2.5%. What purchases are exempt from the south carolina sales tax? You will need to provide. Sales and use tax are exempt from local sales and use tax administered and collected by the department on. How Do I Get A Sales Tax Exemption In South Carolina.

From www.exemptform.com

State Of Tn Sales Tax Exemption Form How Do I Get A Sales Tax Exemption In South Carolina What purchases are exempt from the south carolina sales tax? Learn more about south carolina sales tax exemptions. Once you've successfully registered to collect south carolina sales tax, you'll need to apply the correct rate to all taxable sales, remit sales tax,. Sales and use tax are exempt from local sales and use tax administered and collected by the department. How Do I Get A Sales Tax Exemption In South Carolina.

From digital.library.unt.edu

[Texas sales tax exemption certificate from the Texas Human Rights How Do I Get A Sales Tax Exemption In South Carolina Learn more about south carolina sales tax exemptions. You will need to provide. Sales & use taxpayers whose south carolina tax liability is $15,000 or more per filing period must file and pay electronically. Sales and use tax are exempt from local sales and use tax administered and collected by the department on behalf of local jurisdictions,. While the south. How Do I Get A Sales Tax Exemption In South Carolina.

From www.pdffiller.com

Sales Tax Exempt Certificate Fill Online, Printable, Fillable, Blank How Do I Get A Sales Tax Exemption In South Carolina The scdor offers sales & use tax exemptions to qualified taxpayers. Applying for a sales & use tax exemption. What purchases are exempt from the south carolina sales tax? You will need to provide. The state of south carolina levies a 6% state sales tax, local sales tax is up to 2.5%. Sales & use taxpayers whose south carolina tax. How Do I Get A Sales Tax Exemption In South Carolina.

From www.signnow.com

Tax Exempt Form 2350 Fillable Fill Out and Sign Printable PDF How Do I Get A Sales Tax Exemption In South Carolina You will need to provide. Applying for a sales & use tax exemption. While the south carolina sales tax of 6% applies to most transactions, there. Sales and use tax are exempt from local sales and use tax administered and collected by the department on behalf of local jurisdictions,. The state of south carolina levies a 6% state sales tax,. How Do I Get A Sales Tax Exemption In South Carolina.

From www.formsbank.com

Nc Sales Tax Exemption Form printable pdf download How Do I Get A Sales Tax Exemption In South Carolina Sales and use tax are exempt from local sales and use tax administered and collected by the department on behalf of local jurisdictions,. While the south carolina sales tax of 6% applies to most transactions, there. The scdor offers sales & use tax exemptions to qualified taxpayers. Learn more about south carolina sales tax exemptions. What purchases are exempt from. How Do I Get A Sales Tax Exemption In South Carolina.

From www.fivemilehouse.org

Illinois Tax Exempt Certificate — Five Mile House How Do I Get A Sales Tax Exemption In South Carolina Sales and use tax are exempt from local sales and use tax administered and collected by the department on behalf of local jurisdictions,. You will need to provide. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. Sales & use taxpayers whose south carolina tax. How Do I Get A Sales Tax Exemption In South Carolina.

From inlandrevenue.finance.gov.bs

Tax Compliance Certificate Department of Inland Revenue How Do I Get A Sales Tax Exemption In South Carolina Applying for a sales & use tax exemption. Once you've successfully registered to collect south carolina sales tax, you'll need to apply the correct rate to all taxable sales, remit sales tax,. Learn more about south carolina sales tax exemptions. What purchases are exempt from the south carolina sales tax? While the south carolina sales tax of 6% applies to. How Do I Get A Sales Tax Exemption In South Carolina.

From www.pdffiller.com

Blank Ca Resale Certificate Fill Online, Printable, Fillable, Blank How Do I Get A Sales Tax Exemption In South Carolina Sales & use taxpayers whose south carolina tax liability is $15,000 or more per filing period must file and pay electronically. Once you've successfully registered to collect south carolina sales tax, you'll need to apply the correct rate to all taxable sales, remit sales tax,. What purchases are exempt from the south carolina sales tax? You will need to provide.. How Do I Get A Sales Tax Exemption In South Carolina.

From pafpi.org

Certificate of TAX Exemption PAFPI How Do I Get A Sales Tax Exemption In South Carolina Learn more about south carolina sales tax exemptions. Once you've successfully registered to collect south carolina sales tax, you'll need to apply the correct rate to all taxable sales, remit sales tax,. The scdor offers sales & use tax exemptions to qualified taxpayers. Sales and use tax are exempt from local sales and use tax administered and collected by the. How Do I Get A Sales Tax Exemption In South Carolina.